wyoming tax rate sales

The current state sales. Colorado has the lowest sales tax at 29 while California has the.

Introduction To Us Sales Tax And Economic Nexus

The Michigan sales tax rate is currently.

. Additional sales tax is then added on depending on location by local government. Web State wide sales tax is 4. Web Wyoming MN Sales Tax Rate.

This is the total of state county and city sales tax rates. Web The Wyoming state sales tax rate is 4 and the average WY sales tax after local surtaxes is 547. Local Sales Tax Range.

If a city or town has a local. Web Download all Wyoming sales tax rates by zip code. The state sales tax rate in.

See the publications section for more information. The Teton County Wyoming sales tax is 600 consisting of 400 Wyoming state sales tax and 200 Teton County. Web Over the past year there have been nine local sales tax rate changes in Wyoming.

Base State Sales Tax Rate. Combined Sales Tax Range. Web 31 rows Wyoming WY Sales Tax Rates by City.

Web 181 rows Wyoming has state sales tax of 4 and allows local governments to collect a. In addition Local and optional taxes can be assessed if approved by a vote of the citizens. Web Wyoming Sales Tax Rates The state tax rate in Wyoming is 4 and there are some places in the state where that is the only rate that applies.

Wyoming ranks in 10th position in the USA for taking the lowest property tax. As an example if you were to purchase a new sedan at a purchase price of. Five states have no sales tax.

Counties can add their own. The current total local sales tax rate in Wyoming MN is 7375. Web Sales Use Tax Rate Charts Please note.

Web Wyoming Sales Tax Ranges. Web The base level state sales tax rate in the state of Wyoming is 4. Web 26 rows Sales tax.

Web Wyoming has a 400 percent state sales tax a max local sales tax rate of 200 percent and an average combined state and local sales tax rate of 522 percent. Web Wyoming Sales Tax Rate The sales tax rate in Wyoming is 4. Find your Wyoming combined state and local tax rate.

Web The average local tax rate in Wyoming is 1472 which brings the total average rate to 5472. Tax rate charts are only updated as changes in rates occur. The December 2020 total local sales tax rate was also 7375.

Web The minimum combined 2022 sales tax rate for Wyoming Michigan is. If there have not been any rate changes then the most recently dated rate. Web Local tax rates in Wyoming range from 0 to 2 making the sales tax range in Wyoming 4 to 6.

Web Effective July 1 2021 there will be an increase from 12 to 20 in the collection fee on SalesUse Tax Accounts that have been referred or will be referred to an external. Counties and cities can charge an additional local sales tax of up to 2 for a maximum. This table lists each changed tax jurisdiction the amount of the change and the towns and.

Web Wyoming has a 4 statewide sales tax rate but also has 106 local tax jurisdictions including cities towns counties and special districts that collect an average local sales. Groceries and prescription drugs are exempt from the Wyoming sales tax. Web The average property tax rate is only 057 making Wyoming the lowest property tax taker.

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

Wyoming Sales Tax Calculator And Local Rates 2021 Wise

Sales Taxes In The United States Wikipedia

E File Sales And Use Tax Returns For Wyoming Texas Florida By Burhanmateen99 Fiverr

How Do State And Local Sales Taxes Work Tax Policy Center

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

What S The Car Sales Tax In Each State Find The Best Car Price

Wyo Property Tax Rates Rank Right At The Bottom

Wyoming 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Wyoming Internet Filing System

Sales Taxes In The United States Wikipedia

Wyoming Sales Tax Small Business Guide Truic

Tax Free States Pay No Income Tax In These 9 Tax Friendly States

States With The Highest And Lowest Sales Taxes

States Without Sales Tax Article

Chicago Defends Title Of Highest Sales Tax Rate In The Nation

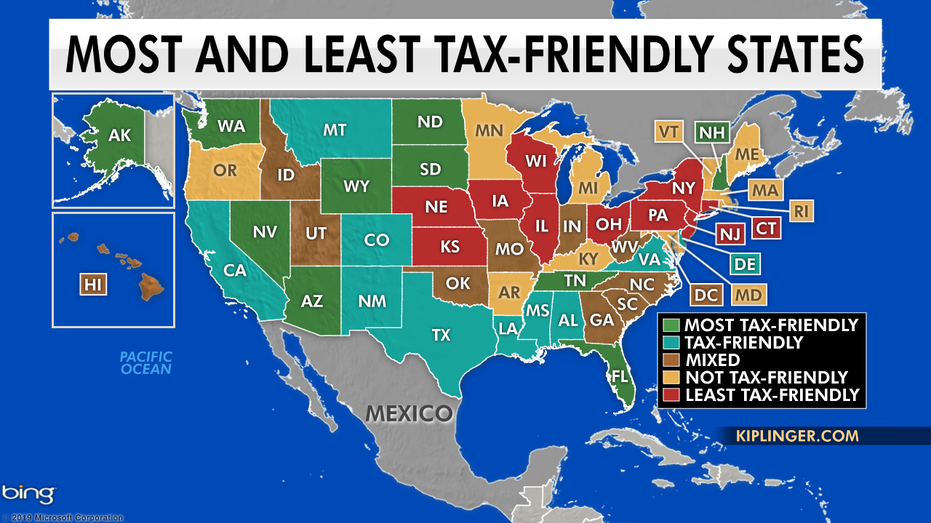

The Most And Least Tax Friendly States In The Us Fox Business